Offshore Renewable Strategy

Under its 2020 Work Programme, the European Commission published its Offshore Renewable Strategy on 19th November 2020, which ‘should help meet the EU's goal of climate neutrality by 2050.’ ≠

In a nutshell, the strategy:

- Aims to reach 300 GW of offshore wind installed capacity by 2050 and for 40 GW for ocean energies;

- Estimates required investments at around €800 billion (2/3 for grid infrastructure, 1/3 for offshore energy generation);

- Wants to give a push to cross-border cooperation via hybrid projects, consisting of cross-border offshore renewable energy plants with potentially various grid connection settings (tackled under TEN-E revision), in the perspective of a future ‘fully meshed off-shore energy system,’ where independent system operators could emerge;

- Plans to create an offshore bidding zone for hybrid projects (cf. more info in Annex SWD), what is thought to be the ‘right framework’ for the development of large-scale offshore projects, including those in hydrogen production;

- Identifies some main funding schemes (not least InvestEU, RRF, CEF) for infrastructure and energy production project development.

In addition to this, in January 2023, in The Hague, nine North Seas nations advanced their commitment to offshore wind energy. During the annual North Seas conference, eight EU nations, along with Norway and the European Commission, endorsed a joint 'Action Agenda.' This agenda aims to foster an integrated energy system by 2050, develop a sustainable and resilient supply chain within Europe and achieve a more harmonious relationship between energy production and nature in the North Seas area. This agreement builds on the collective goals set earlier this year and supports the European Wind Power Package introduced by the Commission in October.

General considerations and targets

In its Offshore Renewable Strategy, the European Commission underlines the EU’s industrial leading role in offshore renewable energies (especially wind) and potential for further development. Although direct electrification via renewable power sources comes first, ‘indirect electrification through hydrogen and synthetic fuels as well as other decarbonised gases,’ is mentioned right after.

Targets in installed capacity are 111 GW of offshore wind by 2030 according to the Wind Charter Treaty, and almost 400 GW for 2040 according to the Offshore Network Developing Plan, and around 40 GW for ocean energies (wave, tidal...) by2050. Required investment amounts to €789 billion split at 2/3 for grid infrastructure and 1/3 for offshore energy generation. On maritime space planning, the EC wants to foster a multiuse/multipurpose approach (mix of usages in maritime space) while promoting biodiversity protection as envisioned in the latest Offshore Network Developing Plan published in January of 2024

Regarding offshore hydrogen production, there are no specific targets. However, with the increase of hydrogen demand driven by the 2022 REPowerEU, Europe plans to produce 10 Mt of domestic hydrogen by an increase to 33 Mt by 2040, as envisaged by the 2040 Climate Targets. Reaching this target will require vast amounts of additional renewable power sources that will have to be developed in parallel to renewable deployment for electrification. According to the Commission, stepping up our renewable hydrogen ambition would require around 500 TWh of additional power generation in 2030 that would also have to comply with the principle of additionality laid out in RFNBO Delegated Act. Hence, offshore hydrogen presents itself as a key ally for achieving these targets. Offshore hydrogen would also ease land availability and environmental pressures onshore while seizing offshore renewable potential.

Member States cooperation

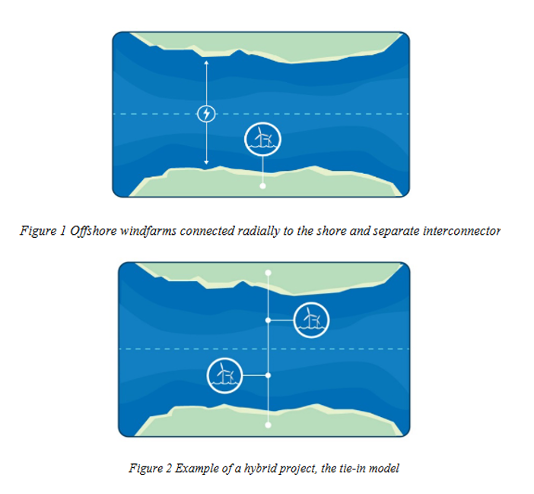

The European Commission highlights the need for Member States to integrate offshore renewable energy development objectives, based on their NECPs (National Energy and Climate Plans), in their national maritime plans. A share of the future offshore grid will ideally be built around hybrid projects, meaning with a cross-border/regional approach where a plant can be connected to several regions/country, instead of a ‘radial’ approach where offshore project is built, connected to the country grid and then a country-to-country grid connection is built. Hybrid projects (cf. Figure 2, compared to Figure 1 which shows traditional offshore projects’ model until now) are seen as an intermediate step for a ‘fully meshed off-shore energy system and grid’. The European Commission wants to foster coordination and cooperation between Member States, firstly by setting targets, then long-term commitments, and plant location identification (which could take the form of MoUs).

Grid planning

The lack of offshore grid or lengthy grid development could be a potential barrier to the deployment of offshore renewables. To tackle this, Offshore hydrogen production and hydrogen pipelines are another option to deliver offshore energy on-shore and should be considered in electricity and gas grid planning. Onshore needs should be considered under grid planning exercises, particularly when linking offshore energy to hydrogen production. The potential role (i.a. ‘new technologies’) for Power-to-X, or PtX (including hydrogen and ammonia), in energy system integration is recalled. PtX could be used to partially make up for the limits of large-scale deployment of high voltage direct current (HVDC) outlined by the EC and to decouple offshore VRES expansion from landing points capacity availability ‘In the medium to longer term (NB: under R&I section of the Strategy) on-site conversion of renewable electricity into hydrogen (i.e. hydrogen offshore production directly by the offshore renewable plant) and its shipping or on-site fuelling will become relevant.’ (up from ‘should be considered’ in the draft). The European Commission highlights the need for TSOs, Member States and regulators cooperation in the planning of grid infrastructure – role of regional coordination centres (RCC) could be reinforced in this respect at a later stage, and in the long run, independent system operators which would manage meshed offshore grids could emerge.

Regulatory framework

The Strategy acknowledges the regulatory gap for offshore hydrogen production, among other innovative project types (the SWD attached to the strategy aims to provide clarification). It plans to amend electricity market rules to make room for energy islands and hybrid projects. It also foresees to create an offshore bidding zone for hybrid projects, what is thought to be the right framework for the development of large-scale offshore projects, including those in hydrogen production. Regulatory framework should enable ‘anticipatory investments’ in the perspective of preparing for hydrogen infrastructure, amongst others. Finally, according to the document, ‘permitting processes’ across Member States should be ‘streamlined’.

It is worth mentioning that the regulatory framework for offshore hydrogen infrastructure is provisioned in the TEN-E regulation. Art. 14 of the TEN-E regulation on offshore grid planning states that the high-level strategic integrated offshore network development plans shall provide a high-level outlook on offshore generation capacities potential and resulting offshore grid needs, including the potential needs for interconnectors, hybrid projects, radial connections, reinforcements, and hydrogen infrastructure. Hence, hydrogen pipeline infrastructure is explicitly included in the TEN-E regulation as an infrastructure (offshore pipelines – not HVDC connected to electrolysers) and, as such, should be fully included in the next ONDP.

Main funding schemes

The main financial instruments that should contribute to the strategy are the following:

- InvestEU (guarantees) – not least through its Strategic Investment Window

- Recovery and Resilience Facility (RRF) (grants and loans) – particularly the flagship Power Up[i]

- It will be important to have a pipeline of mature projects as funds will have to be committed by end of 2023

- Funding can also finance ports infrastructure, grid connections, and support ‘associated reforms needed to facilitate deployment of offshore renewable energy and integration to energy systems”

- Connecting Europe Facility (CEF) (grants, guarantees, i.a.) – notably infrastructure window and new window on cross-border renewables generation

- Additional schemes: Renewable Energy Financing Mechanism[ii], Horizon Europe, Innovation and Modernisation Funds.

In February 2022, the European Parliament adopted an own-initiative resolution on the Strategy. The resolution supports the Strategy and calls for even higher targets for installed offshore wind capacity by 2030 and 2050. For hydrogen, the resolution highlights the opportunity for development of offshore renewable hydrogen, which can contribute to the development of the wider renewable hydrogen market. Furthermore, it recognizes the need for support for research and development to incentivise the industry uptake of renewable hydrogen.

What’s in it for hydrogen?

Offshore hydrogen production and hydrogen pipelines are high up in the options considered to deliver offshore energy onshore, after electric HVDC, nevertheless, there are certain links missing to integrate offshore hydrogen production when this strategy is translated in the Offshore Network Development Plans. As for the moment, the ONDP does not contemplate offshore hydrogen infrastructure as a way to enhance the integration of offshore VRES. While the extension of power grid is considered, the lack of offshore grid or lengthy grid development is highlighted, and the effect on the onshore grid is to be considered under the grid planning exercise, particularly when linking offshore energy to hydrogen production. This is because the onshore grid is already quite congested. All this energy (or a large share of it) could be used to produce renewable hydrogen. Integrating hydrogen production to offshore facilities can help accommodate better integration of offshore renewable energy production.

Besides, the role of PtX (including hydrogen and ammonia) in energy system integration is recalled and linked with Energy System Integration and Hydrogen Strategies. Indeed, PtX could be used to partially make up for the limits of large-scale deployment of HVDC, reinforcing a potential role for hydrogen infrastructure in offshore grid planning.

Finally, the strategy gives consideration to the synergies between hydrogen, grid connection, and the maritime sector: ‘In the medium to longer term, on-site conversion of renewable electricity into hydrogen (i.e. hydrogen offshore production directly by the offshore renewable plant) and its shipping or on-site fuelling will become relevant.’

The funding schemes mentioned above, not least the Recovery and Resilience Plan, could provide funding opportunities for offshore renewable projects featuring hydrogen technologies.

[i] The Commission encourages to channel investments in the national recovery and resilience plans in priority to the seven flagship areas it identified. Power up, for the ‘frontloading of future-proof clean technologies and acceleration of the development and use of renewables’ (including hydrogen) is the first one.

[ii] As of 2021, the new scheme enables a statistical transfer from a Member State hosting the development of a renewable energy project to a Member State not willing or able to develop those projects (e.g. landlocked countries), in exchange of a financial contribution. It can help those countries to reach their RES targets.

Links to the original document and additional information:

An EU strategy to harness the potential of offshore renewable energy for a climate neutral future

European Parliament resolution on a European strategy for offshore renewable energy

Log in

Log in

Search

Search