European Hydrogen Bank

The European Hydrogen Bank is one of key initiatives announced by the European Commission for 2023. Its establishment was announced in the State of the European Union address on 14th September 2022 by the Commission President. The aim of the Bank is to bridge the investment gap between supply and demand of renewable hydrogen to achieve the REPowerEU targets. The main framework of the Bank was detailed in a communication issued in March 2023.

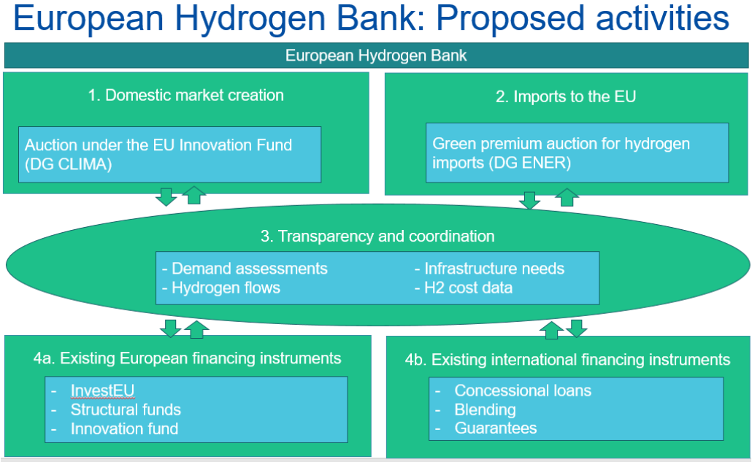

The Hydrogen Bank is a financing instrument implemented by the European Commission, consisting of two new financing mechanisms to support renewable hydrogen production; one for production within the EU and one for international production (essentially referring to imports). The Bank aims to unlock private investments in the hydrogen value chain by connecting supply with demand from European off takers, acting as a steppingstone for a global renewable hydrogen market. The Bank governance is structured into four pillars: the domestic financing mechanisms, the international financing mechanism, transparency and coordination for demand visibility, and lastly coordination and facilitation of financial blending.

Domestic market

Under the first pillar, the goal is to support the creation of a domestic market through an auction-based mechanism under the EU Innovation Fund. The first auction (IF23 Auction) was launched in November 2023 and ran until February 2024, with the following objectives:

- Connect EU domestic renewable hydrogen supply and demand;

- Reduce the cost-cap between renewable and fossil hydrogen;

- Enable price discovery and market formation for hydrogen;

- De-risk European hydrogen projects;

- Reduce administrative burdens and costs due to short, lean and transparent procedures.

The auction had as its aim to support RFNBO production (as defined in the Renewable Energy Directive), with the bid price as the requested unit contribution (fixed premium) per kb of RFNBO hydrogen production, which will be paid for a maximum of 10 years. Only projects with a minimum installed capacity of 5 MW electrolysis were eligible. The budget of the first auction was €800 million.

On 30 April 2024, the results of the European Hydrogen Bank’s first competitive bidding were released. Seven renewable hydrogen projects across the EU will receive a total of 720 € million, with a plan to produce 1.58 million tonnes of renewable hydrogen over ten years, avoiding more than 10 million tonnes of CO2 emissions.

The European Commission is consulting with hydrogen stakeholders on how to improve the second call of the Hydrogen Bank that is expected by Q3 2024.

Under the domestic pillar, the Bank can also be used as an Auction-as-a-Service for Member States, enabling them to use their own resources for projects on their territory by through the established EU-wide auction mechanism. Germany became the first EU country to participate in such a scheme and will make €350 million available for the Hydrogen Bank auction.

Supporting International Hydrogen Production

The aim of the international pillar of the hydrogen bank is to support partner countries to accelerate their transition towards climate neutrality and contribute to their broader social and economic development. The Commission is still developing the design of the international leg of the Bank. The Commission is nevertheless working together with the German Ministry for Economic Affairs and Climate Action to bring the concept of the Hydrogen Bank international scheme together with the EU countries’ financial resources and use the H2Global scheme of Germany as a vehicle for such international auctions.

Coordination and transparency

Through its activities the Bank will increase transparency on hydrogen flows, transactions and prices. Such information will be coordinated by the Commission, with the intent to provide transparent price information and develop price benchmarks. As part of the process to assess EU demand for domestic and imported renewable hydrogen, a voluntary, non-binding call for expressions of interest by EU off-takers will be organised. To ensure diversification of renewable hydrogen sources over time the Commission is exploring the possibility to create an instrument based on the transparency provisions of the EU Energy Platform (PRISMA).

Coordination of existing project financing

Considering the multitude of funding and financing instruments that exist both at the EU and Member State level, bringing coordination and clarity between support instruments will increase the transparency and effectiveness of support for the hydrogen sector. Therefore, under the Hydrogen Bank, the Commission intends to explore the potential to increase information sharing and awareness of support measures that exist at the EU and Member States level. Additionally, by streamlining support instruments, it can be ensured that they mutually reinforce each other.

What’s in it for hydrogen?

The Hydrogen Bank is an important support tool for the development of the nascent hydrogen market. Apart from providing direct funding support to hydrogen production projects, the Bank increases the attractiveness of those projects for investors. The Bank also represents an important commitment towards European Union partner countries, as they will be able to benefit from support for the establishment of their own hydrogen value-chains.

Lastly, the Bank is an important steppingstone in the development of the hydrogen market, where the lack of clarity on existing hydrogen flows, transactions and prices has a negative effect on investment.

Links to the original document and additional information:

European Hydrogen Bank Communication

Factsheet: European Hydrogen Bank

Commission outlines European Hydrogen Bank to boost renewable hydrogen

Log in

Log in

Search

Search